Comprehensive visibility across your entire SFT portfolio.

Compliance

Automated compliance that never misses a beat.

Trade Data Extraction

SFTR Compliance

End-to-End Automation

Seamlessly integrate with existing systems to automate data extraction, validation, and reporting. Our AI-driven engine ensures completeness and accuracy before submission.

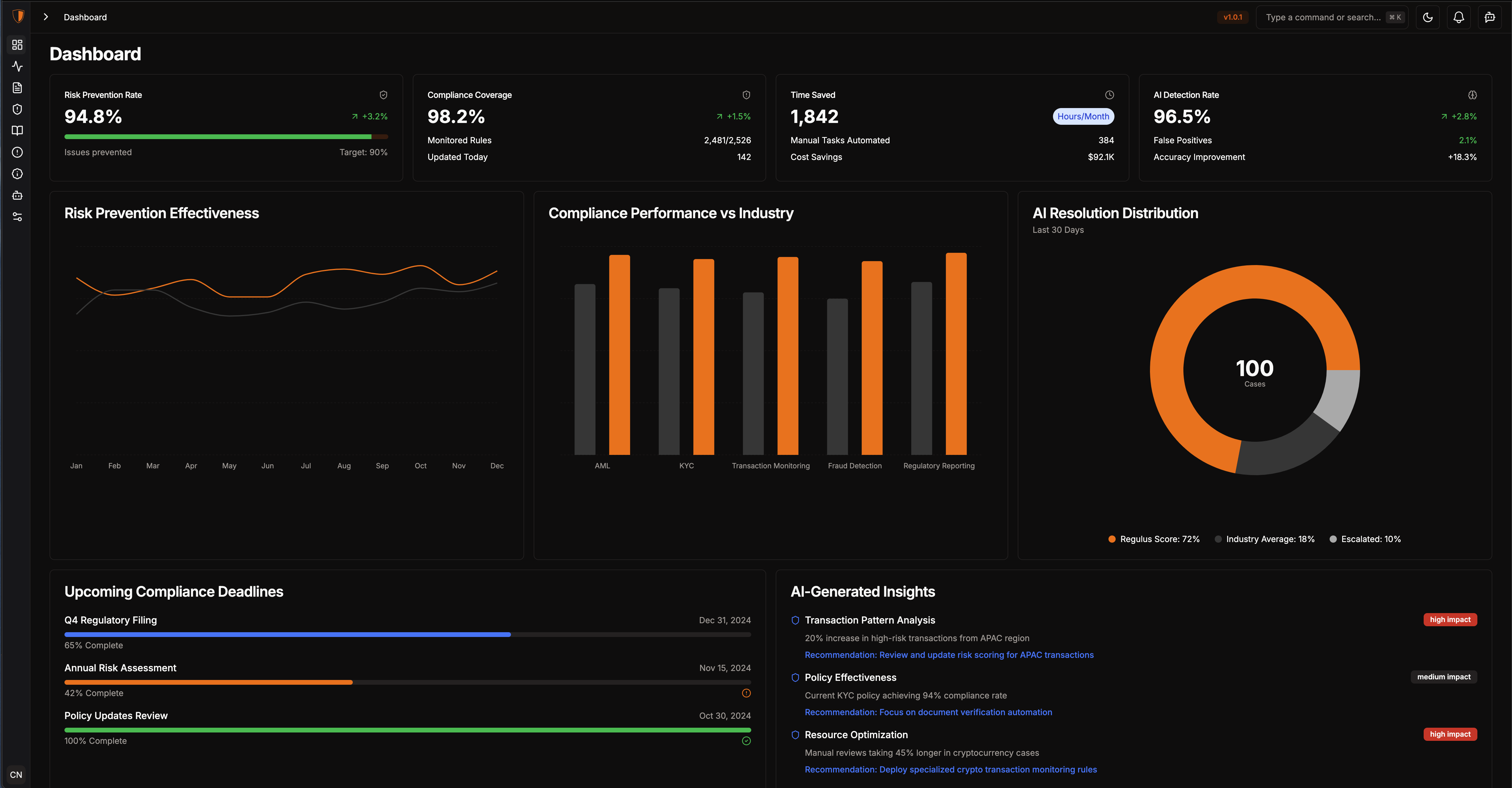

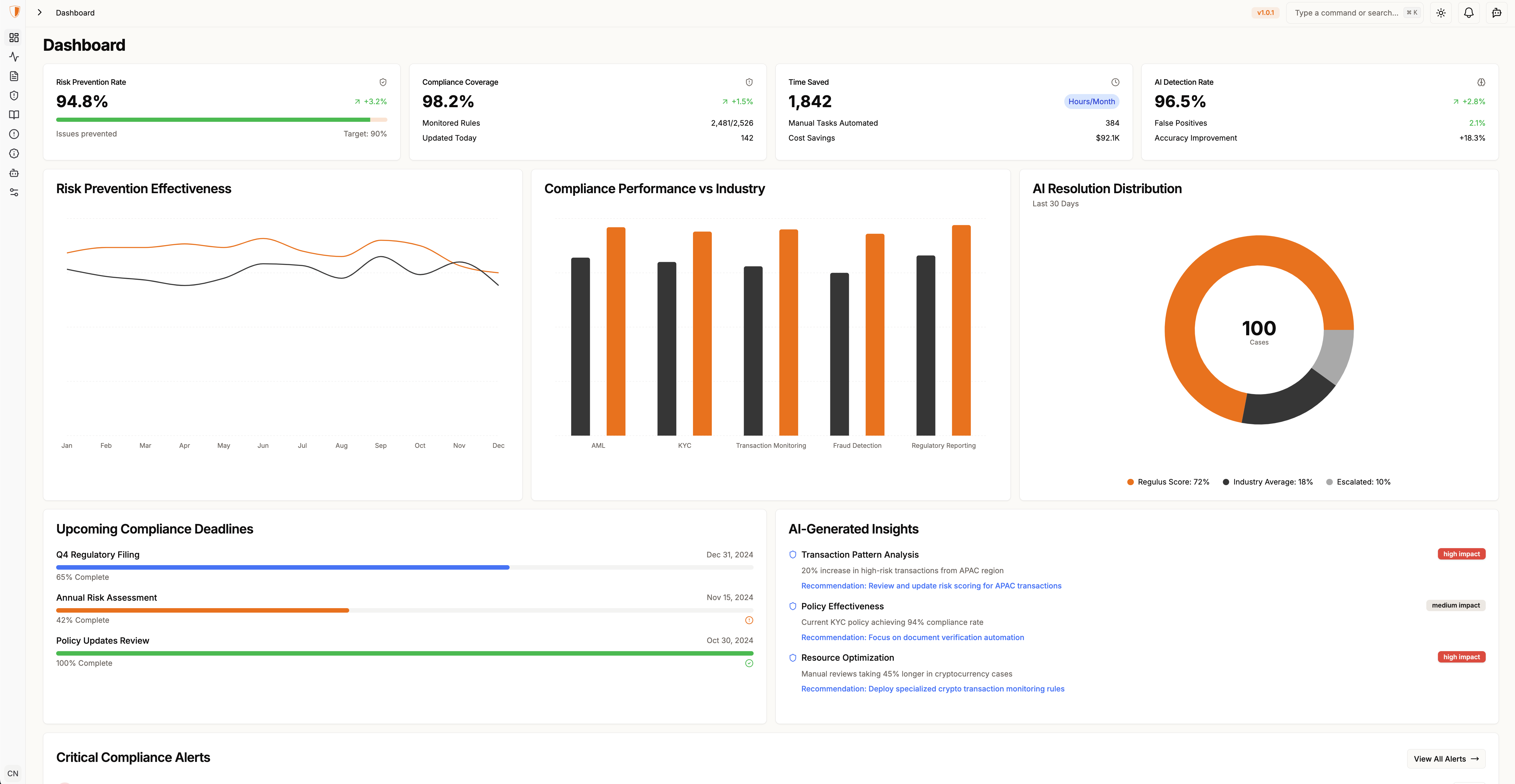

Risk Management

Real-Time Monitoring

Monitor collateral positions, exposures, and liquidity metrics in real-time across all business units and geographies with our unified risk dashboard.

Analytics

Predictive Intelligence

Leverage machine learning models to forecast margin requirements and identify potential liquidity gaps based on market volatility patterns.

Integration

API-First Architecture

Built on a flexible API framework for seamless integration with your existing systems and easy onboarding of new technologies.

Security

Enterprise-Grade Security

Advanced encryption, multi-factor authentication, and intrusion detection systems protect your sensitive financial data.

Optimization

Intelligent collateral and risk optimization.

Collateral Management

Smart Optimization

Our advanced algorithms suggest optimal collateral allocations by assessing eligibility criteria, haircuts, and cost of funds, enabling broader use of your securities.

Risk Assessment

Early Warning System

AI-driven alerts for deteriorating credit conditions and significant market events affecting counterparties.

Reporting

Custom Analytics

User-friendly dashboards tailored to different roles, providing relevant KPIs and deep-dive analytics capabilities.

Automation

Intelligent Workflows

Automated collateral movements and reallocation ensure swift response to market changes while maintaining optimal portfolio efficiency.